Calgary’s rental market continues to evolve, driven by rising demand, limited supply, and affordability challenges for buyers. For real estate investors, the big question is: what’s the better investment — a traditional condo or a purpose-built rental (PBR) property? Both options come with unique advantages, risks, and long-term strategies. Here’s a breakdown to help guide your decision.

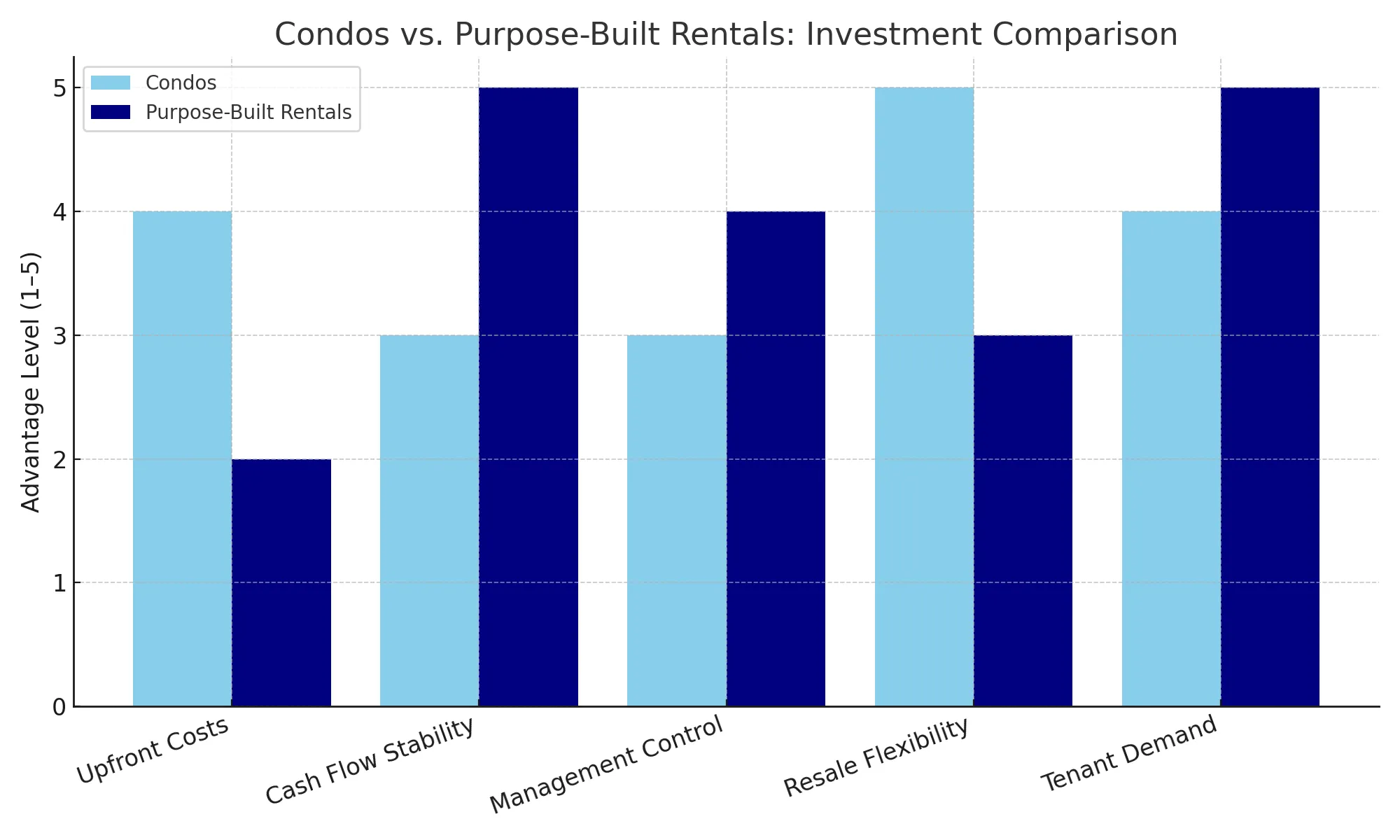

1. Upfront Costs and Financing

Condos: Typically more accessible for first-time investors. Lower purchase prices make them easier to finance, especially with rising interest rates. However, condo fees can impact profitability.

Purpose-Built Rentals (PBRs): These properties often require higher upfront capital and are usually geared toward institutional or large-scale investors. Financing may involve commercial loans with stricter criteria.

2. Cash Flow and Stability

Condos: Rental income can vary depending on tenant turnover, seasonal demand, and competition from new projects. While condos can generate positive cash flow, it often depends on location and management efficiency.

PBRs: Designed specifically for long-term rental income, PBRs typically offer stable occupancy rates. Tenants tend to stay longer due to better amenities and community-focused design, which can create predictable cash flow.

3. Management and Control

Condos: As an investor, you’re subject to condo board rules and monthly fees. Renovation flexibility is limited, and unexpected special assessments can affect returns.

PBRs: Investors (or developers) maintain full control of the property, but this comes with higher management responsibilities — from maintenance to tenant relations.

4. Resale and Exit Strategy

Condos: Easier to sell on the open market to both investors and owner-occupiers. Liquidity is generally higher, especially in central Calgary neighborhoods.

PBRs: Resale is usually limited to other investors, which can narrow your buyer pool. However, long-term appreciation tied to rental income stability can balance this.

5. Tenant Demand and Market Trends

Condos: Appeal strongly to young professionals and students looking for modern living in urban cores. Calgary’s population growth supports ongoing demand, though competition is increasing.

PBRs: With affordability challenges for buyers, demand for rentals has surged. Families and long-term tenants often prefer PBRs because of their design and community orientation.

We’ve already explored this topic from the renter’s perspective in our post The Future of Calgary Rentals: Purpose-Built Rentals vs. Condos. Now let’s look at how these same differences impact investors.

Final Thoughts

So, should you invest in a condo or a purpose-built rental?

Condos are better suited for individual investors seeking flexibility, easier entry, and liquidity.

Purpose-Built Rentals cater to long-term investors seeking stability, higher tenant retention, and predictable income.

Ultimately, your choice should align with your investment goals, risk tolerance, and capital resources.

Are you considering an investment property in Calgary? Whether you’re leaning toward a condo or exploring opportunities in purpose-built rentals, we can help you analyze market data and maximize your returns. Contact us today to discuss your investment strategy.

Posted by Ray Yang on

Leave A Comment